UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

Filed by the Registrant ☒

|

|

|

|

Filed by a Party other than the Registrant ☐

|

|

|

|

Check the appropriate box:

|

|

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a‑12

|

|

|

|

|

|

CAPSTONE TURBINE CORPORATION

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

N/A

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

CAPSTONE TURBINE CORPORATION

21211 Nordhoff Street

Chatsworth, California 91311

July 18, 2016

Dear Capstone Turbine Stockholder:

You are cordially invited to attend the 2016 annual meeting of stockholders (the “Annual Meeting”) of Capstone Turbine Corporation (the “Company”) to be held at the Company’s corporate offices located at 21211 Nordhoff Street, Chatsworth, California, 91311 on August 31, 2016, at 10:00 a.m., Pacific Time. We look forward to meeting you and discussing the accomplishments of the Company for the fiscal year ended March 31, 2016.

Details of the business to be conducted at the Annual Meeting are provided in the attached Notice of Annual Meeting of Stockholders and Proxy Statement.

In accordance with rules adopted by the Securities and Exchange Commission, we are mailing to our stockholders a Notice of Internet Availability instead of a paper copy of the Proxy Statement and our 2016 Annual Report to Stockholders. The Notice of Internet Availability contains instructions on how stockholders can access the documents over the Internet as well as how stockholders can receive a paper copy of our proxy materials, including the Proxy Statement, the 2016 Annual Report to Stockholders and a proxy card.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted. Therefore, I urge you to vote by proxy as soon as possible over the Internet or by phone as instructed in the Notice of Internet Availability or, if you receive paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card. If you attend the Annual Meeting, you may withdraw your proxy and vote your shares personally.

This year’s Annual Meeting is a particularly important one, and your vote is essential. VCM Group LLC (“VCM”), a beneficial holder of 200 shares of our Common Stock, or less than 0.001% of our outstanding Common Stock, acquired by VCM in February 2016, has notified the Company that it intends to nominate, pursuant to our bylaws, on its own proxy, nine individuals for election as directors of the Board of Directors at the Annual Meeting. The Company informed VCM that VCM’s notice failed to comply with the Company’s bylaws and that, as a result, VCM will not be entitled to make nominations for election to the Board of Directors at the Annual Meeting. However, at this time, we have no knowledge as to whether VCM will actually proceed with the solicitation for the election of its slate of director nominees at the Annual Meeting. You may receive solicitation materials, including proxy statements and proxy cards, from VCM seeking your proxy to vote for its slate of director nominees. We bear no responsibility for the accuracy or completeness of any solicitation materials distributed, or any statements made, by or on behalf of VCM. For additional information about VCM, please see the “Background of the Solicitation” section on page 2 of the accompanying Proxy Statement.

THE BOARD OF DIRECTORS URGES YOU NOT TO SUBMIT ANY PROXY CARD SENT TO YOU BY, OR ON BEHALF OF, VCM. THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE BOARD OF DIRECTORS’ NOMINEES.

If you already have submitted a proxy card sent to you by, or on behalf of, VCM, you can revoke that proxy by submitting a subsequent proxy over the Internet or by phone as instructed in the Notice of Internet Availability or, if you

receive paper copies of the proxy materials by mail, by completing, dating, signing and returning the enclosed white Capstone proxy card. Only the most recently dated proxy you submit will be counted. Any proxy you submit may be revoked at any time prior to its exercise at the Annual Meeting as described in the accompanying Proxy Statement.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the Company.

|

|

|

|

|

Sincerely,

|

|

|

|

|

|

Darren R. Jamison

President and Chief Executive Officer

|

Chatsworth, California

YOUR VOTE IS IMPORTANT

PLEASE VOTE OVER THE INTERNET OR BY TELEPHONE AS INSTRUCTED IN THESE

MATERIALS OR COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED WHITE CAPSTONE PROXY CARD AS PROMPTLY AS POSSIBLE.

CAPSTONE TURBINE CORPORATION

21211 Nordhoff Street

Chatsworth, California 91311

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held August 31, 2016

The Capstone Turbine Corporation (the “Company” or “Capstone”) 2016 annual meeting of stockholders (the “Annual Meeting”) will be held at the Company’s corporate offices located at 21211 Nordhoff Street, Chatsworth, California, 91311, on August 31, 2016, at 10:00 a.m., Pacific Time, for the following purposes:

1.To elect eight members to Capstone’s Board of Directors to serve until the next annual meeting or until their successors have been elected and qualified;

2.To hold a non‑binding advisory vote on executive compensation;

3.To ratify the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2017; and

4.To transact any other business that is properly brought before the Annual Meeting or any adjournments or postponements thereof.

The foregoing items of business are more fully described in the accompanying Proxy Statement. The Board of Directors has fixed the close of business on July 5, 2016 as the record date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. Only holders of record of the Company’s Common Stock at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. In the event there are not sufficient shares to be voted in favor of any of the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies.

Whether or not you plan to attend the Annual Meeting, please vote over the Internet or by telephone as instructed in these materials or complete, sign, date and return the white Capstone proxy card promptly. The proxy is being solicited on behalf of the Board of Directors of Capstone for use at the Annual Meeting.

This year’s Annual Meeting is a particularly important one, and your vote is essential. VCM Group LLC (“VCM”), a beneficial holder of 200 shares of our Common Stock, or less than 0.001%, of our outstanding Common Stock, acquired by VCM in February 2016, has notified the Company that it intends to nominate, pursuant to our bylaws, on its own proxy, nine individuals for election as directors of the Board of Directors at the Annual Meeting. The Company informed VCM that VCM’s notice failed to comply with the Company’s bylaws and that, as a result, VCM will not be entitled to make nominations for election to the Board of Directors at the Annual Meeting. However, at this time, we have no knowledge as to whether VCM will actually proceed with the solicitation for the election of its slate of director nominees at the Annual Meeting. You may receive solicitation materials, including proxy statements and proxy cards, from VCM seeking your proxy to vote for its slate of director nominees. We bear no responsibility for the accuracy or completeness of any solicitation materials distributed, or any statements made, by or on behalf of VCM. For additional information about VCM, please see the “Background of the Solicitation” section on page 2 of the accompanying Proxy Statement.

THE BOARD OF DIRECTORS URGES YOU NOT TO SUBMIT ANY PROXY CARD SENT TO YOU BY, OR ON BEHALF OF, VCM. THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE BOARD OF DIRECTORS’ NOMINEES.

If you already have submitted a proxy card sent to you by, or on behalf of, VCM, you can revoke that proxy by submitting a subsequent proxy over the Internet or by phone as instructed in the Notice of Internet Availability or, if you receive paper copies of the proxy materials by mail, by completing, dating, signing and returning the enclosed white Capstone proxy card. Only the most recently dated proxy you submit will be counted. Any proxy you submit may be revoked at any time prior to its exercise at the Annual Meeting as described in the accompanying Proxy Statement.

Please note that space limitations make it necessary to limit attendance at the Annual Meeting to stockholders. Registration will begin at 8:30 a.m. and the Annual Meeting will begin at 10:00 a.m. Each stockholder may be asked to present valid picture identification, such as a driver’s license or passport. Stockholders holding stock in brokerage accounts will need to bring a copy of a brokerage statement reflecting stock ownership as of the record date. Cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting.

Directions to the Company’s corporate offices can be obtained by contacting the Company at (818) 734‑5300.

|

|

|

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

Clarice Hovsepian

Secretary

|

Chatsworth, California

July 18, 2016

CAPSTONE TURBINE CORPORATION

21211 Nordhoff Street

Chatsworth, California 91311

PROXY STATEMENT

For Annual Meeting Of Stockholders

To Be Held August 31, 2016

Information About the 2016 Annual Meeting

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors of Capstone Turbine Corporation (the “Company” or “Capstone”) from holders of issued and outstanding shares of Common Stock, par value $.001 per share, to be voted at the 2016 annual meeting of stockholders (the “Annual Meeting”), to be held at the Company’s corporate offices located at 21211 Nordhoff Street, Chatsworth, California, 91311, on August 31, 2016, at 10:00 a.m., Pacific Time, for the purposes set forth in the accompanying notice and herein, and any adjournments or postponements thereof.

A copy of Capstone’s 2016 Annual Report to Stockholders (the “2016 Annual Report”) and the Proxy Statement and accompanying white Capstone proxy card were first mailed or made available to stockholders on or about July 18, 2016. The 2016 Annual Report includes Capstone’s audited consolidated financial statements.

The Company will provide a listen‑only live audio webcast of the Annual Meeting. The listen‑only live audio webcast will be available via the Company’s website under www.capstoneturbine.com/investor. A replay of the webcast will be available on the website following the live event for 30 days.

Voting Procedures

If you were a stockholder of record of the Company’s Common Stock at the close of business on July 5, 2016, you are entitled to notice of, and to vote at, the Annual Meeting. As of the record date, 30,124,442 shares of Common Stock were outstanding.

Proxies properly executed, duly returned to us and not revoked will be voted in accordance with the instructions given. Where no instructions are given, subject to the requirements described below, such proxies will be voted: FOR the election as directors of the nominees listed in this Proxy Statement; FOR the approval of the compensation of our Named Executive Officers (as described in the “Compensation Discussion and Analysis” section of this Proxy Statement); and FOR the ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2017. If any matter not described in this Proxy Statement is properly presented for action at the Annual Meeting, the persons named on the proxy card will have discretionary authority to vote on the action according to their best judgment. Each stockholder of record on July 5, 2016 is entitled to one vote for each share

of Common Stock held by such stockholder on that date. The required quorum for the transaction of business at the Annual Meeting is a majority of the shares of our Common Stock eligible to be voted on the record date.

Abstentions and broker non votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting, and abstentions, but not broker non votes, as to particular proposals will be treated as shares entitled to vote. A broker non vote occurs when a broker holding shares for a beneficial holder does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial owner. Without your instructions, your broker or nominee is permitted to use its own discretion and vote your shares on “routine” matters (such as Proposal 3), but it is not permitted to use discretion and vote your shares on “non-routine” matters (such as Proposals 1 and 2). However, when a matter to be voted on at a meeting of stockholders is the subject of a contested solicitation, banks, brokers and other nominees do not have discretion to vote your shares on that matter. Accordingly, if VCM Group LLC (“VCM”) proceeds with the solicitation for the election of its slate of director nominees at the Annual Meeting, which potential solicitation is further described under the heading “Background of the Solicitation” below, all of the proposals described in this Proxy Statement will be deemed “non-routine” matters, and banks, brokers and other nominees will not be permitted to vote your shares on any of those proposals without your specific instructions. We urge you to give specific voting instructions to your broker on all three proposals. Broker non votes will have no direct impact on any proposal. Concerning the election of directors, you may: (a) vote for all director nominees as a group; (b) withhold authority to vote for all director nominees as a group; or (c) vote for all director nominees as a group except those nominees you identify on the appropriate line. For Proposals 2 and 3, abstentions will have the same effect as a vote against these proposals. For Proposal 1, abstentions will have no effect on the outcome of the vote.

You may revoke your proxy at any time before it is actually voted at the Annual Meeting by: (i) delivering written notice of revocation to the Secretary of Capstone at our address above; (ii) submitting a later dated proxy; or (iii) attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not, by itself, constitute revocation of the proxy.

Voting Electronically via the Internet or by Telephone

Whether you hold shares directly as the stockholder of record or through a broker, trustee or other nominee, as the beneficial owner you may direct how your shares are voted without attending the Annual Meeting. Stockholders are encouraged to vote their proxies by Internet, by telephone or by completing, signing, dating and returning a white Capstone proxy card, but not by more than one method. If you vote by Internet or telephone, you do not need to return a white Capstone proxy card. If you vote by more than one method, only the last vote that is submitted will be counted and each previous vote will be disregarded. Please refer to the instructions provided in the Notice of Internet Availability or proxy card provided to you for information on the available voting methods.

Solicitation of Proxies

We will pay the expense of soliciting proxies and the cost of preparing, assembling and mailing material in connection with the solicitation of proxies. In addition, we have retained Morrow & Co., LLC to assist in the solicitation. We will pay Morrow & Co., LLC approximately $5,000 for their assistance in the solicitation of proxies. Our directors, officers or employees may solicit proxies by mail, e‑mail, telephone, facsimile or other means. These individuals will not receive any additional compensation for these efforts. Our aggregate expenses related to the solicitation (excluding the amount normally expended for a solicitation for an election of directors in the absence of a contest and costs represented by salaries and wages of regular employees and officers) are expected to be approximately $100,000, of which approximately $75,000 has been incurred to date.

Background of the Solicitation

On March 14, 2016, the Company received a letter from VCM, a beneficial holder of 200 shares of the Company’s Common Stock, or less than 0.001%, of our outstanding Common Stock, giving notice (the “Nomination Notice”) of VCM’s intention to nominate nine director candidates for election to the Company’s Board of Directors at the Annual Meeting. The Company believes that the Nomination Notice was deficient because it did not meet the

requirements prescribed under Article II, Section 14 of the Company’s bylaws. On April 1, 2016, the Company sent to VCM a response letter to that effect. As a result, the Company does not believe that VCM is entitled to make nominations for election to the Board of Directors at the Annual Meeting. The Company has received no further communications from VCM, and, at this time, we have no knowledge as to whether VCM will actually proceed with the solicitation for the election of its slate of director nominees at the Annual Meeting. You may receive solicitation materials, including proxy statements and proxy cards, from VCM seeking your proxy to vote for its slate of director nominees. We bear no responsibility for the accuracy or completeness of any solicitation materials distributed, or any statements made, by or on behalf of VCM.

Proposals of Stockholders for the 2017 Annual Meeting of Stockholders

Stockholder proposals or nominations for directors intended to be presented at the 2017 annual meeting of stockholders (the “2017 Annual Meeting”) must be in writing and received at Capstone’s executive offices no later than the date listed below and must comply with Capstone’s bylaws and the proxy rules of the Securities and Exchange Commission (the “SEC”). If appropriate notice of a stockholder proposal is not received at Capstone’s executive offices prior to the close of business on March 20, 2017, the proposal will be deemed untimely. Pursuant to Rule 14a‑8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Company’s bylaws, an untimely proposal will not be included in the Company’s proxy statement or proxy card for the 2017 Annual Meeting and cannot be brought before the 2017 Annual Meeting by the proponent.

In addition to stockholder nominations made in accordance with the procedures described above, Capstone’s Nominating and Corporate Governance Committee will consider stockholder recommendations of candidates for election to the Board of Directors if such recommendations are submitted by the date and in accordance with the policies described in the “Director Recommendation and Nomination Process” section elsewhere in this Proxy Statement.

The date of this Proxy Statement is July 18, 2016.

PROPOSAL 1

ELECTION OF DIRECTORS TO THE BOARD OF DIRECTORS

Our bylaws provide that, unless otherwise determined by the Board of Directors, the Board of Directors shall consist of eight members. Effective June 1, 2006, the Board of Directors determined to increase the size of the Board of Directors from eight members to nine members. Effective June 24, 2016, the Board of Directors determined to decrease the size of the Board of Directors from nine members to eight members. Capstone’s Board of Directors currently consists of eight members, seven of whom the Company proposes for re-election at the Annual Meeting. One of the current members of the Board of Directors intends to retire at the Annual Meeting, and a non-incumbent director candidate is being proposed for election at the Annual Meeting in the retiring director’s stead.

John V. Jaggers, a director since 1993, retired at the 2015 annual meeting of stockholders (the “2015 Annual Meeting”). Darrell J. Wilk, a director since 2006, intends to retire at the Annual Meeting. As a result of Mr. Jaggers’ retirement, and in anticipation of Mr. Wilk’s retirement, the Nominating and Corporate Governance Committee undertook a formal search process for director candidates, targeting candidates with experience, skills and other attributes relevant to the Company’s strategic objectives, and engaging a third-party search firm to assist in identifying and evaluating potential candidates based on specifications established by the Nominating and Corporate Governance Committee. As a result of this search process, Paul DeWeese was identified by the third-party search firm as a potential director candidate and, following his evaluation by the Nominating and Corporate Governance Committee, was recommended by the Nominating and Corporate Governance Committee for appointment to the Board of Directors.

Each of the nominees possesses unique qualifications, skills and attributes that complement the performance of the full Board of Directors. The experiences that each has obtained from their respective professional backgrounds have qualified them to serve on Capstone’s Board of Directors. Each of the nominees has been evaluated and recommended for nomination to the Board of Directors by the Nominating and Corporate Governance Committee.

The proxies cannot vote for a greater number of persons than the number of nominees named. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by the present Board of Directors to fill the vacancy. The Company does not expect that any nominee will be unable or decline to serve as a director. The term of office of each person elected as a director will continue until the next annual meeting of stockholders or until the director’s successor has been elected and qualified, or the earlier of the director’s resignation or removal. The table and text below set forth information about each nominee as of July 5, 2016.

|

|

|

|

|

|

|

|

Nominees

|

|

Age

|

|

Director Since

|

|

|

Gary D. Simon(1)

|

|

67

|

|

2005

|

|

|

Richard K. Atkinson

|

|

65

|

|

2005

|

|

|

Paul DeWeese

|

|

49

|

|

—

|

|

|

Darren R. Jamison

|

|

50

|

|

2006

|

|

|

Noam Lotan

|

|

64

|

|

2005

|

|

|

Gary J. Mayo

|

|

62

|

|

2007

|

|

|

Eliot G. Protsch

|

|

63

|

|

2002

|

|

|

Holly A. Van Deursen

|

|

57

|

|

2007

|

|

|

(1)

| |

Chairman of the Board of Directors. |

Gary D. Simon. Mr. Simon has been a director since August 2005 and has served as Chairman of the Board of Directors since August 2010. Mr. Simon has served as the President of Sigma Energy Group, a clean energy investment and business development firm, since October 2003. He has also served as the Chairman of CleanStart, a business accelerator associated with the nonprofit Sacramento Regional Technology Alliance, since October 2005. Since 2003 he has served on the Board of Directors of SmartPower, a non‑profit green energy marketing organization, and as Chairman since 2011. Previously, Mr. Simon served as the Chairman, President and Chief Executive Officer of Acumentrics Corporation (“Acumentrics”), a privately held manufacturer of innovative power supply equipment. He continued to serve as a member of the Acumentrics board of directors and then was reappointed Chief Executive Officer in April 2014. Since July 2006, Mr. Simon has been a limited partner in Velocity Venture Capital and a director of Jadoo

Power, a privately held manufacturer of small (less than 1,000 watt) portable power generators and solar hot water heaters. Since January 2014, he has been a director of Oorja Fuel Cells, a privately held manufacturer of small (less than 5,000 watt) portable methanol‑fueled power generators. Mr. Simon has served as a consultant to several start‑up businesses involved with clean energy technologies and as an advisor to the Connecticut and Massachusetts clean energy funds. Mr. Simon has served as Senior Vice President, Strategy and Development at Northeast Utilities (NYSE: NU) and as a member of the Board of Directors of Northeast Optic Network, a public company that operated a high speed fiber optic network from Boston to Washington, D.C. Mr. Simon holds a Bachelor of Arts degree in Microbiology from Indiana University and a Master of Science degree in Ecology from the University of California, Davis.

Mr. Simon brings to the Board of Directors substantial executive and governance experience along with expertise in marketing, sales, management consulting and raising capital in both public and private markets. Mr. Simon also assists the Board of Directors in the areas of strategy and corporate governance.

Richard K. Atkinson. Mr. Atkinson has been a director since December 2005. Mr. Atkinson served as Chief Financial Officer of Gradient Resources, a company engaged in the exploration and development of geothermal resources as well as the construction, ownership and operation of geothermal power plants, from May 2010 through March 2014. Mr. Atkinson was formerly Senior Vice President and Chief Financial Officer of US BioEnergy Corporation (Nasdaq: USBE), a company that built and operated large, efficient ethanol plants. He previously served in the positions of Vice President, Chief Financial Officer and Corporate Secretary of Pope & Talbot, a wood and pulp products business. Before joining Pope & Talbot, Mr. Atkinson worked for Sierra Pacific Resources as its Vice President and Chief Financial Officer. Mr. Atkinson received his Bachelor of Science degree from the University of Oregon and his Master of Business Administration degree from the University of Nevada, Reno.

Among his other skills and expertise, Mr. Atkinson’s financial expertise, decades of experience in corporate governance and ongoing executive experience aid the Board of Directors in matters of finance, accounting and risk management.

Paul DeWeese. Mr. DeWeese is the Chief Executive Officer of Epic Industrial Solutions, LLC, a company that provides parts and services for industrial engines and compressors in the oil and gas and industrial markets. He has held this position since May 2015. Prior to Epic Industrial Solutions, Mr. DeWeese served as Chief Executive Officer of Southwest Oilfield Products, Inc., an aftermarket supplier for drilling rigs in the upstream oil and gas industry, from May 2012 through April 2015. Before joining Southwest Oilfield Products, Mr. DeWeese worked for Socotherm S.p.a., a pipe coating company based in Italy as its Chief Executive Officer. Prior to Socotherm, Mr. DeWeese served as President of CRC-Evans Automatic Welding, a world leader in welding systems for onshore and offshore pipeline construction projects, providing an extensive range of equipment for a variety of project applications. Mr. DeWeese spent 13 years with Cameron International Corporation in various leadership roles handling their centrifugal compressor and reciprocating compressor aftermarket business. Mr. DeWeese received his Bachelor of Science in Business Administration degree from Regis University, and his Master of Business Administration degree from the University of Michigan.

Mr. DeWeese brings to the Board of Directors over 19 years in the oil and gas field services industry as a senior executive with vast experience running both public and private equity backed companies which were domestic and internationally headquartered.

Darren R. Jamison. Mr. Jamison joined Capstone in December 2006 as President and Chief Executive Officer and has been a director since December 2006. He also has served as a director for Endurance Wind Power, a privately held Canadian-headquartered wind turbine manufacturer, since December 2015. Mr. Jamison joined Capstone from Northern Power Systems, Inc., a company that designs, manufactures and sells wind turbines into the global marketplace, where he served as President and Chief Operating Officer and Executive Vice President of Operations. Prior to joining Northern Power Systems, Inc., Mr. Jamison was Vice President and General Manager of Distributed Energy Solutions for Stewart & Stevenson Services, Inc., a leading designer, manufacturer and marketer of specialized engine‑driven power generation equipment to the oil and gas, renewable and energy efficiency markets. He holds a Bachelor of Arts degree in Business Administration and Finance from Seattle University.

Among his other skills and expertise, Mr. Jamison brings to the Board of Directors his unique perspective as President and Chief Executive Officer of the Company and substantial executive and industry experience within the Company’s major market verticals.

Noam Lotan. Mr. Lotan has been a director since June 2005. Currently, he is a Venture Partner with OurCrowd Management Ltd. OurCrowd is one of the world’s leading accredited investors-only crowdfunding platforms. From November 2010 until December 2015, Mr. Lotan served as the President, Chief Executive Officer and a director of Resonate Industries, a development stage company in the clean energy sector. Prior to Resonate, Mr. Lotan served as Chief Executive Officer and a director of MRV Communications, Inc. (Nasdaq: MRVC), a global supplier of optical communications solutions to the telecommunications industry. Mr. Lotan also served as President and Chief Financial Officer of MRV. Mr. Lotan served as a Director of the European Operations of Fibronics International Inc., a manufacturer of fiber optic communication networks (Nasdaq: FBRX), and as Managing Director of Fibronics (UK) Ltd., the United Kingdom subsidiary of Fibronics. Prior to such time, Mr. Lotan held a variety of sales and marketing positions with Fibronics and the Hewlett Packard Company. Mr. Lotan served as an officer in the Israeli Defense Forces. Mr. Lotan holds a Bachelor of Science degree in Electrical Engineering from Technion, the Israel Institute of Technology, and a Master of Business Administration degree from INSEAD (the European Institute of Business Administration, Fontainebleau, France).

Among his other skills and expertise, Mr. Lotan brings to the Board of Directors decades of executive experience with a publicly traded technology company and a unique perspective on the Asian and European markets.

Gary J. Mayo. Mr. Mayo has been a director since October 2007. He is the Founding Principal of Sustainability Excellence Associates, LLC, a consulting firm specializing in strategic planning for sustainability and environmental strategy development. He is also Chief Operating Officer and a Founding Director of Education Resource Strategies, Inc., a privately held company that provides web‑based marketing services to educational institutions. Mr. Mayo is the former Vice President of Corporate Sustainability Strategies in the Energy and Environmental Services Division of MGM Resorts International (NYSE: MGM), one of the world’s leading global hospitality companies. Mr. Mayo also held a number of senior leadership positions with Ford Motor Company (NYSE: F) and its spun‑off subsidiary Visteon Corporation (NYSE: VC), including Director of the Distributed Power Generation Strategic Business Unit and Global Director of Corporate Responsibility and Government Affairs. Mr. Mayo holds a Bachelor of Science degree in Marketing from C.W. Post College of Long Island University and a Master of Business Administration degree from the Fuqua School of Business at Duke University. He also successfully completed the UCLA Anderson Graduate School of Management, Director Education and Certification Program in May 2009.

Mr. Mayo brings to the Board of Directors more than a decade of expertise in strategic planning and the development of complex corporate initiatives along with extensive experience in sustainability and environmental issues, as well as distributed power generation, sales, marketing, operations management and government affairs.

Eliot G. Protsch. Mr. Protsch has been a director since April 2002 and served as Chairman of the Board of Directors from October 2002 through August 2010. Mr. Protsch served as Senior Executive Vice President, Chief Operating Officer, Chief Financial Officer, and Executive Vice President Energy Delivery of Alliant Energy Corporation (NYSE: LNT), an energy holding company, and President of Interstate Power and Light Company, a subsidiary of Alliant. Mr. Protsch currently serves on the Board of Directors for American Family Insurance, Universal Acoustic and Emissions Technologies and Green Companies, Inc. Mr. Protsch is an active angel investor in energy technology and is President of Wapsie Investment and Advisory, LLC; a personal investment and advisory vehicle specializing in energy technology investments and advisory services. He received his Master of Business Administration degree and his Bachelor of Business Administration degree in Economics and Finance from the University of South Dakota. Mr. Protsch is a Chartered Financial Analyst.

Mr. Protsch brings to the Board of Directors his unique perspective as a former executive officer of a utilities company, financial expertise and insight into sales, marketing and corporate governance.

Holly A. Van Deursen. Ms. Van Deursen has been a director since October 2007. Ms. Van Deursen has served as a director for Actuant Corporation (NYSE: ATU) since 2008, Bemis Company, Inc. (NYSE: BMS) since 2008, Anson Industries (private) since 2006 and Petroleum Geo‑Services (OSE: PGS) since 2006. Prior to her current roles, Ms. Van Deursen was employed by BP plc/Amoco Corporation and served on the Top‑Forty Executive Team as Group Vice President, Petrochemicals and Group Vice President, Strategy. Ms. Van Deursen received her Bachelor of Science degree in Chemical Engineering from the University of Kansas and her Master of Business Administration degree from the University of Michigan.

Among her other skills and expertise, Ms. Van Deursen brings to the Board of Directors decades of experience in the energy and chemical industries, a unique perspective on the Asian and European markets and substantial experience in strategic and annual planning, corporate governance and risk management. In addition, her diverse experience on other boards of both public and private companies is of significant benefit to the Company.

Required Vote for Approval; Recommendation of the Board of Directors

Assuming the presence of a quorum, the eight nominees for director receiving the highest number of votes will be elected to Capstone’s Board of Directors. Information regarding the method by which votes will be counted appears on page one of this Proxy Statement under the heading “Voting Procedures.”

The Board of Directors DOES NOT endorse any director nominee of VCM and urges you not to sign or return any proxy card that may be sent to you by VCM. Please note that voting to “WITHHOLD” with respect to any of VCM’s nominees on a proxy card supplied by or on behalf of VCM is not the same as voting for the Company’s Board of Directors’ nominees, because a vote to “WITHHOLD” with respect to any nominees of VCM’s proxy card will revoke any proxy you previously submitted. If you have already voted using VCM’s proxy card, you can revoke that proxy by submitting a subsequent proxy over the Internet or by phone as instructed in the Notice of Internet Availability or, if you receive paper copies of the proxy materials by mail, by completing, dating, signing and returning the enclosed white Capstone proxy card. Only the most recently dated proxy you submit will be counted. If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Morrow & Co., LLC, at 800-662-5200.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF THE CANDIDATES NOMINATED BY THE BOARD OF DIRECTORS.

PROPOSAL 2

NON‑BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd‑Frank Wall Street Reform and Consumer Protection Act of 2010 enables the Company’s stockholders to vote to approve, on an advisory basis, the compensation of the Company’s Named Executive Officers as described in the “Compensation Discussion and Analysis” section and the executive compensation tables contained in this Proxy Statement. The stockholders elected to hold this vote annually at the Company’s 2011 annual meeting of stockholders. Because your vote is advisory, it will not be binding on the Board of Directors or the Compensation Committee; however, the Compensation Committee will review the voting results and take them into consideration when making future decisions regarding executive compensation. The Board of Directors is requesting that the stockholders hold this vote pursuant to Section 14A of the Exchange Act.

Executive Compensation Overview

As described in greater detail in the “Compensation Discussion and Analysis” section beginning on page 20 of this Proxy Statement, the Company’s executive compensation program for its Named Executive Officers is designed to attract, motivate and retain a highly qualified group of executives and maintain a close correlation between the rewards to the Company’s executives and the strategic success of the Company and the performance of its stock. The Company believes that its executive compensation programs, which provide the Named Executive Officers a significant portion of their compensation in the form of performance-based equity grants, have been effective at promoting the achievement of positive results in its performance criteria, appropriately aligning pay and performance and enabling the Company to attract and retain talented executives within its industry.

Stockholder Engagement

The Compensation Committee values the perspectives and concerns of our stockholders regarding executive compensation. The Compensation Committee has in the past and intends to continue to maintain in the future an open dialogue with stockholders to foster greater communication and transparency. At the 2015 Annual Meeting, we sought an advisory vote on our executive compensation. Following the 2015 Annual Meeting, the Compensation Committee reviewed the results of the say‑on‑pay vote and the feedback received from stockholders to assess whether any actions needed to be taken in response.

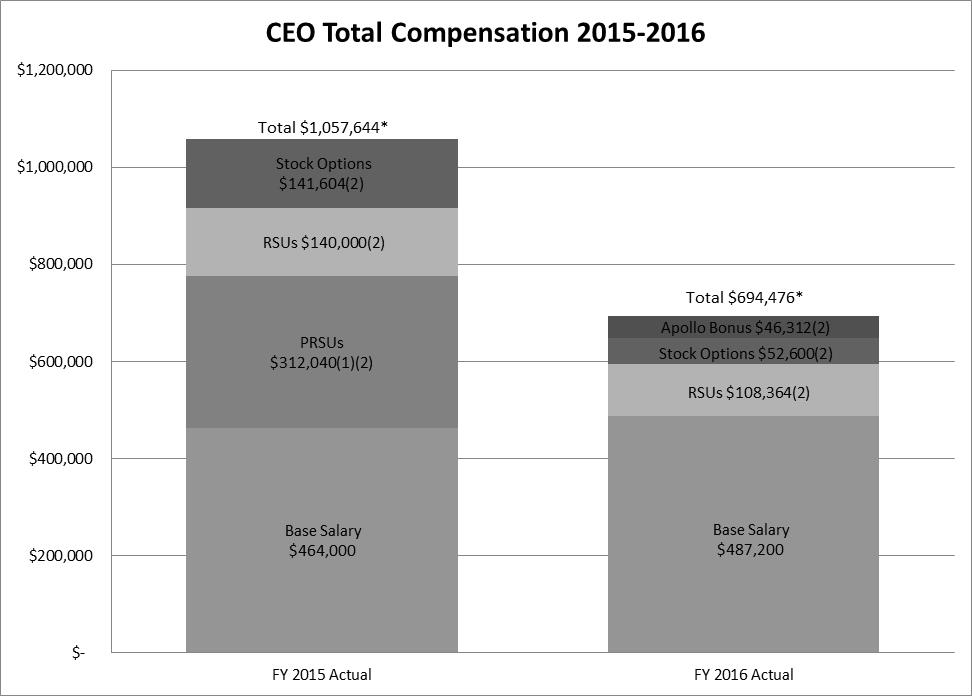

2016 Fiscal Year Compensation

The 2016 Fiscal Year was a challenging year for the Company as it faced various internal and external challenges that caused management to take strategic measures to reposition the Company for future growth and profitability. In light of such challenges, the Company continued to execute its strategic plan during the 2016 Fiscal Year while maintaining its compensation policies to align performance incentives with the interests of the Company’s stockholders. Certain highlights from the 2016 Fiscal Year include the following:

|

·

| |

The Compensation Committee reviewed and maintained the peer group established for the 2016 Fiscal Year that the Company uses to benchmark the compensation of its Named Executive Officers; |

|

·

| |

The Compensation Committee modified the executive annual incentive program to strengthen the link between executive pay and performance, and there were no cash incentive payments to Named Executive Officers for the 2016 Fiscal Year as a result of performance goals not being achieved; |

|

·

| |

The Compensation Committee implemented a compensatory program (the “Apollo Program”) designed to incentivize continued efficiency, reliability and other improvements with respect to the Company’s 200 kilowatt and 1000 kilowatt microturbines; and |

|

·

| |

The Compensation Committee maintained a Performance Restricted Stock Unit Program (the “PRSU Program”) to link executive compensation with Company performance. |

2017 Fiscal Year Compensation

The executive compensation decisions we made for the fiscal year ending March 31, 2017 (the “2017 Fiscal Year”), all of which we believe are reflective of our ongoing pay‑for‑performance philosophy, include the following:

|

·

| |

The base salaries of the Named Executive Officers for the 2017 Fiscal Year remain unchanged from the 2016 Fiscal Year; |

|

·

| |

As of the date of this Proxy Statement, no formal executive annual incentive plan has been established for the 2017 Fiscal Year in order to allow the Company to focus on its strategic plan; and |

|

·

| |

As of the date of this Proxy Statement, no long-term equity incentive awards have been granted for the 2017 Fiscal Year. |

Proposal

The Company is asking its stockholders to indicate their support for the compensation of the Named Executive Officers disclosed in this Proxy Statement, which is described in the Summary Compensation Table on page 32 of this Proxy Statement and under “Compensation Discussion and Analysis.” The disclosures in the Proxy Statement are made in accordance with SEC regulations (including Item 402 of SEC Regulation S‑K). This proposal, commonly known as the “say‑on‑pay” proposal, gives our stockholders the opportunity to express their views on the Company’s executive compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Named Executive Officers and the policies and practices described in this Proxy Statement. Accordingly, the Company is asking its stockholders to vote “FOR” the following resolution:

RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the Company’s Named Executive Officers, as disclosed pursuant to SEC regulations in the Company’s Proxy Statement for the 2016 annual meeting of stockholders.

Required Vote for Approval; Recommendation of the Board of Directors

Although the results of this vote are not binding on the Board of Directors or the Compensation Committee, the Compensation Committee will review the voting results and take them into consideration when making future decisions regarding executive compensation. Information regarding the method by which votes will be counted appears on page one of this Proxy Statement under the heading “Voting Procedures.”

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RESOLUTION TO APPROVE THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS.

PROPOSAL 3

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected KPMG LLP as the Company’s independent registered public accounting firm for the 2017 Fiscal Year. KPMG LLP is considered by management to be well‑qualified. Representatives of KPMG LLP are expected to be present at the Annual Meeting and will have an opportunity to make any statement they consider appropriate and to respond to any appropriate stockholders’ questions at that time.

Required Vote for Ratification; Recommendation of the Board of Directors

Stockholder ratification of the Audit Committee’s selection of KPMG LLP as the Company’s independent registered public accounting firm is not required by the Company’s bylaws or otherwise; however, the Board of Directors has elected to submit the selection of KPMG LLP to the Company’s stockholders for ratification. The Company is seeking an affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting, if a quorum is present, in order to ratify the selection of the independent registered public accounting firm. If the appointment of KPMG LLP is not ratified by the stockholders, the matter will be referred to the Audit Committee for further review. Information regarding the method by which votes will be counted appears on page one of this Proxy Statement under the heading “Voting Procedures.”

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE PROPOSAL TO RATIFY THE SELECTION OF KPMG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

GOVERNANCE OF THE COMPANY AND PRACTICES OF THE BOARD OF DIRECTORS

Board of Directors; Leadership Structure

As of the date hereof, the Board of Directors consists of eight directors: Gary D. Simon (Chair), Richard K. Atkinson, Darren R. Jamison, Noam Lotan, Gary J. Mayo, Eliot G. Protsch, Holly A. Van Deursen and Darrell J. Wilk. As noted above, Mr. Wilk will be retiring at the Annual Meeting. The Board of Directors has determined that all of the current members of the Board of Directors, other than Mr. Jamison, are “independent directors” as defined by Nasdaq rules. Further, the Board of Directors has determined that Paul DeWeese, the director nominee who is not currently a member of the Board of Directors, if elected to the Board of Directors at the Annual Meeting, will be an “independent director” under Nasdaq rules.

The Company expects that, following the Annual Meeting, and subject to the election or re-election, as the case may be, of each of the director nominees contemplated by this Proxy Statement, the Board of Directors will consist of eight directors: Holly A. Van Deursen (Chair), Richard K. Atkinson, Paul DeWeese, Darren R. Jamison, Noam Lotan, Gary J. Mayo, Eliot G. Protsch and Gary D. Simon.

The Board of Directors met fifteen (15) times during the fiscal year ended March 31, 2016 (the “2016 Fiscal Year”), and each of the directors attended or participated in more than 75% of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board of Directors on which such director served. The Company strongly encourages each member of the Board of Directors to attend each annual meeting of stockholders. All of the directors serving on the Board of Directors at the time attended the 2015 Annual Meeting. The Company’s independent directors met in executive session, without members of the Company’s management present, at all of the in person meetings of the Board of Directors in the 2016 Fiscal Year.

The Board of Directors is committed to having a sound governance structure that promotes the best interests of all of the Company’s stockholders. To that end, the Board of Directors has evaluated and actively continues to examine emerging corporate governance trends and best practices. Stockholder perspectives play an important role in that process. The level of importance afforded to stockholder perspectives by the Board of Directors is evident upon a closer review of the Board of Directors’ governance structure. Some key points regarding that structure are as follows:

|

·

| |

The Board of Directors is predominantly independent. Of our eight directors, only one (our President and Chief Executive Officer) is an employee of the Company. Further, the Board of Directors has affirmatively determined that seven of our eight directors are independent under SEC and Nasdaq corporate governance rules, as applicable. |

|

·

| |

All members of the Board of Directors are elected annually to one‑year terms. |

|

·

| |

Our board committees are comprised exclusively of independent directors. |

|

·

| |

Our independent directors meet in executive session at every in‑person board meeting. |

|

·

| |

We have separated the roles of Chairman of the Board of Directors and Chief Executive Officer. Our Chairman focuses on board oversight responsibilities, strategic planning, setting board agendas and mentoring company officers, as well as facilitating communications between the Board of Directors and management. |

|

·

| |

Our Board of Directors is very active. As noted above, each of our directors attended more than 75% of the 2016 Fiscal Year board meetings and meetings of the committees on which such director served. |

We believe our Board of Directors structure serves the interests of stockholders by balancing board continuity and the promotion of long‑term thinking with the need for director accountability.

Board Committees

The Board of Directors has designated an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee.

Audit Committee

The Audit Committee currently consists of Messrs. Atkinson (Chair), Lotan, Protsch and Simon. Each member of the Audit Committee is an “independent director” pursuant to Nasdaq rules and is “financially literate” within the meaning of Nasdaq rules. The Audit Committee is constituted to comply with Section 3(a)(58)(A) of the Exchange Act and is responsible, among other items, for: (i) monitoring the Company’s financial reporting and overseeing accounting practices; (ii) annually retaining the independent public accountants as auditors of the books, records, financial statements and accounts of the Company; (iii) monitoring the scope of audits made by the independent public accountants and the audit reports submitted by the independent public accountants; (iv) overseeing the systems of internal control which management and the Board of Directors have established; and (v) discussing with management and the independent and internal auditors the Company’s major financial risk exposure and the steps taken to monitor and control such exposure. In addition, the Audit Committee has the duties of a “qualified legal compliance committee,” including monitoring and reviewing stockholder complaints, and also reviews and approves all related‑party transactions. The Audit Committee operates under a written charter adopted by the Board of Directors, a copy of which is available on the Company’s website at www.capstoneturbine.com. Pursuant to its written charter, the Audit Committee reviews its charter on an annual basis for compliance, best practices and any other needed updates or changes. During the 2016 Fiscal Year, the Audit Committee held four (4) meetings. The Board of Directors has determined that each member of the Audit Committee is an “audit committee financial expert,” as that term is defined by applicable rules adopted by the SEC. The Board of Directors has further determined that each member of the Audit Committee is independent as defined by Nasdaq rules.

The Company expects that, following the Annual Meeting, and subject to the election or re-election, as the case may be, of each of the director nominees contemplated by this Proxy Statement, the Audit Committee will consist of Messrs. Protsch (Chair), Atkinson, Lotan and Simon.

Compensation Committee

The Compensation Committee currently consists of Messrs. Mayo (Chair) and Wilk and Ms. Van Deursen. The Compensation Committee is comprised solely of directors who qualify as independent for purposes of Nasdaq rules, SEC Rule 16b‑3 and Section 162(m) of the Code in conformance with the Compensation Committee’s charter. The functions of the Compensation Committee include: (i) for the purposes of compensation, reviewing the performance and development of the Company’s senior management in achieving corporate goals and objectives; (ii) determining the salary, benefits and other compensation of the executive officers and reviewing the compensation programs for the Company; and (iii) administering the following benefit plans of Capstone: the 2000 Employee Stock Purchase Plan, the 2000 Equity Incentive Plan (the “Incentive Plan”) and the Executive Performance Incentive Plan (the “Executive Plan”). The Compensation Committee operates under a written charter adopted by the Board of Directors, a copy of which is available on the Company’s website at www.capstoneturbine.com. Pursuant to its written charter, the Compensation Committee reviews its charter on an annual basis for compliance, best practices and any other needed updates or changes. During the 2016 Fiscal Year, the Compensation Committee held eight (8) meetings. Processes and procedures for determining executive compensation are discussed elsewhere in this Proxy Statement in the section entitled “Compensation Discussion and Analysis.”

The Company expects that, following the Annual Meeting, and subject to the election or re-election, as the case may be, of each of the director nominees contemplated by this Proxy Statement, the Compensation Committee will consist of Messrs. Mayo (Chair) and Simon and Ms. Van Deursen.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee currently consists of Ms. Van Deursen (Chair) and Messrs. Mayo, Protsch and Wilk. The Nominating and Corporate Governance Committee is comprised solely of “independent directors” as defined by Nasdaq rules in conformance with the Nominating and Corporate Governance Committee’s charter. The Nominating and Corporate Governance Committee is responsible for, among other things, (i) monitoring corporate governance matters; (ii) recommending to the full Board of Directors candidates for election to the Board of Directors and committees of the Board of Directors; and (iii) coordinating the Board of Directors evaluation process. The Nominating and Corporate Governance Committee operates under a written charter adopted by the Board of Directors, a copy of which is available on the Company’s website at www.capstoneturbine.com. Pursuant to its written charter, the Nominating and Corporate Governance Committee reviews its charter on an annual basis for compliance, best practices and any other needed updates or changes. During the 2016 Fiscal Year, the Nominating and Corporate Governance Committee held five (5) meetings. The Nominating and Corporate Governance Committee met subsequent to the end of the 2016 Fiscal Year to recommend to the full Board of Directors each of the nominees for election to the Board of Directors as presented herein.

The Company expects that, following the Annual Meeting, and subject to the election or re-election, as the case may be, of each of the director nominees contemplated by this Proxy Statement, the Nominating and Corporate Governance Committee will consist of Messrs. DeWeese (Chair), Mayo and Protsch.

Risk Oversight

The Board of Directors oversees an enterprise‑wide approach to risk management designed to support the achievement of organizational objectives, including strategic objectives, to improve long‑term organizational performance and to enhance stockholder value. A fundamental part of risk management is not only understanding the risks the Company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. The involvement of the full Board of Directors in setting the Company’s business strategy is a key part of its assessment of management’s appetite for risk and also a determination of what constitutes an appropriate level of risk for the Company. The full Board of Directors participates in an annual enterprise risk management assessment.

While the Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of the Board of Directors also have responsibility for risk management. In particular, the Audit Committee focuses on financial risk, including internal controls, and receives an annual risk assessment report from the Company’s internal auditors. In setting compensation, the Compensation Committee strives to create incentives that encourage a level of risk‑taking behavior consistent with the Company’s business strategy and is responsible for oversight with respect to compensation and succession planning risks. Also, the Company’s Nominating and Corporate Governance Committee conducts an annual assessment of the risk management process and reports its findings to the full Board of Directors.

Board of Directors and Committee Performance Evaluations

The charter of each of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee requires an annual performance evaluation, and the Company’s Corporate Governance Principles also mandate an annual evaluation of the Board of Directors. Such performance evaluations are designed to assess whether the Board of Directors and its committees function effectively and make valuable contributions to the Company. In April 2016, all members of the Company’s Board of Directors were asked to assess the performance of the Board of Directors and each committee on which they serve and identify areas for improvement through the completion of a detailed questionnaire for each such committee and the Board of Directors. Counsel for the Company reviewed the completed questionnaires, consolidated the responses and delivered summaries of the responses to the Nominating and Corporate Governance Committee, which reviewed the summaries in consultation with counsel for the Company and reported findings to the Board of Directors in June 2016. The Nominating and Corporate Governance Committee and the Board of Directors discussed the results of the performance evaluations and asked each of the appropriate committees to discuss the consensus suggestions and put a follow‑up process in place. The Nominating and Corporate Governance

Committee has reviewed the results, identified the key areas for improvement and is developing a strategy for addressing the areas most in need of improvement. Each member of the Board of Directors was also asked to complete a peer review and assess, on a confidential basis, the service and contributions of each other member of the Board of Directors by completing a confidential board member evaluation form. Counsel for the Company reviewed and consolidated the responses to the confidential board member evaluation form. The Chairperson of the Nominating and Governance Committee presented the responses, on an anonymous basis, to the Board of Directors in June 2016.

Director Recommendation and Nomination Process

The Nominating and Corporate Governance Committee has a policy for the consideration of director candidates recommended by stockholders and will consider all bona fide recommended candidates for director if submitted in accordance with the policy. The policy provides that any stockholder recommendation must include the specific information required by the policy, must be submitted in writing to:

Capstone Turbine Corporation

21211 Nordhoff Street

Chatsworth, CA 91311

Attention: Chair of Nominating and Corporate Governance Committee

Care of: Clarice Hovsepian, Secretary

and must be received by the Nominating and Corporate Governance Committee at least 180 days prior to the annual meeting of stockholders. All such recommendations should include the following: (i) the name, age, business address and residence address of the prospective candidate and the name and record address of the stockholder submitting the recommendation, as well as the number of shares of stock of the Company which are owned of record or beneficially by that stockholder; (ii) a statement from the prospective candidate consenting to being named in the proxy and proxy card if selected as a nominee and to serving on the Board of Directors if elected; (iii) a statement explaining whether the prospective candidate is “independent” under applicable laws, Nasdaq rules and otherwise; (iv) biographical data of the prospective candidate, including former and current service on other boards of directors, business experience and current occupation, and any other information relating to the prospective candidate and the recommending stockholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors; (v) transactions and relationships between the recommended candidate and the recommending stockholder, on the one hand, and the Company or Company management, on the other hand, as well as a description of all arrangements or understandings between the recommending stockholder and the prospective candidate and any other person pursuant to which the nomination is being made by the stockholder; (vi) the prospective candidate’s Company stock trading history; (vii) any material proceedings to which the prospective candidate or his or her associates is a party that are adverse to the Company; (viii) the prospective candidate’s involvement in any past or present legal proceedings, including any involvement in legal proceedings involving the Company; (ix) information regarding whether the recommending stockholder or the recommended candidate, or affiliates of either of those parties, have any plans or proposals for the Company; (x) an explanation as to whether the recommending stockholder and the prospective candidate intend to use the nomination to redress personal claims or grievances against the Company or others or to further personal interests or special interests not shared by the Company’s stockholders at large; (xi) whether the prospective candidate is proposed to be nominated at the annual meeting of stockholders or is provided solely as a recommendation for consideration by the Nominating and Corporate Governance Committee; and (xii) any other relevant information concerning the prospective candidate. The Nominating and Corporate Governance Committee reserves the right to request additional information as it deems appropriate.

In addition to stockholder recommendations as described above, the Company’s bylaws permit stockholders to nominate directors at a meeting of the stockholders. Any stockholder nomination must comply with the applicable provisions of the Company’s bylaws and the SEC’s proxy rules and will be handled in accordance with the Company’s bylaws and applicable laws.

The Nominating and Corporate Governance Committee reviews the composition and size of the Board of Directors and determines the criteria for Board of Directors membership. In addition, the Nominating and Corporate Governance Committee reviews the qualifications of prospective candidates to determine whether they will make good

candidates for membership on the Company’s Board of Directors. This consideration includes, at a minimum, a review of each prospective candidate’s character, judgment, experience, expertise, age, diversity, independence under applicable law and freedom from other conflicts, as well as other factors that the Nominating and Corporate Governance Committee deems relevant in light of the needs of the Board of Directors and the Company and/or that are in the best interests of the Company, including relevant experience, the ability to dedicate sufficient time, energy and attention to performance of Board of Directors duties, financial expertise, experience with a company that has introduced a new, technologically advanced product or service to the marketplace and existing relationships within target industries or public policy institutions that may benefit the Company and whether the prospective candidate is a Nominating and Corporate Governance Committee‑selected prospective candidate or a stockholder‑recommended prospective candidate. The Nominating and Corporate Governance Committee selects qualified candidates and recommends those candidates to the Board of Directors, and the Board of Directors then decides if it will invite the candidates to be nominees for election to the Board of Directors.

The Nominating and Corporate Governance Committee also considers issues of diversity, such as diversity of education, professional experience and differences in viewpoints and skills. The Nominating and Corporate Governance Committee does not have a formal diversity policy in terms of considering nominees for directors, but it actively considers all relevant factors, including the factors outlined above, when evaluating potential nominees to the Board of Directors. The Nominating and Corporate Governance Committee developed a matrix of all relevant qualifications, skills and experience possessed by the incumbent members of the Board of Directors and identified certain areas where the Board of Directors needed additional attributes including, but not limited to, diversity. The Board of Directors and the Nominating and Corporate Governance Committee believe that it is essential that members of the Board of Directors represent diverse viewpoints.

The Nominating and Corporate Governance Committee uses the process described herein to identify prospective candidates for the Board of Directors and to evaluate all candidates, including candidates recommended by stockholders in accordance with the Company’s policy regarding stockholder recommendations and the director nominations process. The Nominating and Corporate Governance Committee: (i) reviews the composition and size of the Board of Directors and determines the criteria for Board of Directors membership; (ii) evaluates the Board of Directors for effectiveness and makes a verbal presentation of its findings to the Board of Directors; (iii) determines whether the current members of the Board of Directors who satisfy the criteria for Board of Directors membership are willing to continue in service; if the current members of the Board of Directors are willing to continue in service, the Nominating and Corporate Governance Committee evaluates the performance of such board members and considers those current members for re‑nomination, and if the current members of the Board of Directors are not willing to continue in service or if there will be an increase in the number of directors on the Board of Directors, the Nominating and Corporate Governance Committee considers candidates who meet the criteria for Board of Directors membership; (iv) if necessary, engages a search firm to assist with the identification of potential candidates; (v) compiles a list of potential candidates; (vi) evaluates the prospective candidates, including candidates recommended by stockholders, to determine which of the prospective candidates, if any, will best represent the interests of all stockholders and determines whether any conflicts of interest exist; (vii) holds meetings to narrow the list of prospective candidates; (viii) along with the Chairman of the Board of Directors and management, interviews a select group of prospective candidates; (ix) approves the candidate or candidates who are most likely to advance the best interests of the stockholders; and (x) recommends the selected candidate or candidates to the Board of Directors and the stockholders for approval. The Nominating and Corporate Governance Committee, which may request the assistance of members of the Board of Directors who are not on the Nominating and Corporate Governance Committee in the execution of its duties, carefully documents the selection and evaluation process.

Stockholder Communications

The Company has a policy whereby stockholders may communicate directly with the Company’s Board of Directors, or individual members of the Board of Directors, by writing to the Company at:

Capstone Turbine Corporation

21211 Nordhoff Street

Chatsworth, CA 91311

Attention: Clarice Hovsepian, Secretary

and indicating prominently on the outside of any envelope that the communication is intended for: (i) the Board of Directors; (ii) the Chairman of the Board of Directors; (iii) a specific committee of the Board of Directors; (iv) the non‑management directors; or (v) any director or subset of directors of the Board of Directors. The Secretary of the Board of Directors reviews all correspondence and regularly forwards to the appropriate director, directors or the Board of Directors, copies of all communications that, in the opinion of the Secretary, deal with the functions of or otherwise require the attention of individual directors, the Board of Directors or committees or subsets thereof. Unless, in the opinion of the Secretary, a communication is improper or irrelevant, a communication will not be withheld from its intended recipient(s) without the approval of the Chairman of the Board of Directors, the Chair of the appropriate committee or the director who presides during non‑management executive sessions.

Compensation Committee Interlocks and Insider Participation

During the 2016 Fiscal Year, the Compensation Committee consisted of Messrs. Mayo (Chair), Jaggers (until his retirement from the Board of Directors at the 2015 Annual Meeting) and Wilk and Ms. Van Deursen. None of the Compensation Committee members have at any time been an officer or employee of the Company nor did any of the members have any relationship with the Company requiring disclosure by the Company during the 2016 Fiscal Year. During the 2016 Fiscal Year, none of the Company’s executive officers served as a member of the compensation committee of another entity, an executive officer of which served on the Compensation Committee of Capstone; none of the Company’s executive officers served as a director of another entity, an executive officer of which served on the Compensation Committee of Capstone; and none of the Company’s executive officers served as a member of the compensation committee of another entity, an executive officer of which served as a director of Capstone.

AUDIT COMMITTEE REPORT

In performing its functions, the Audit Committee acts primarily in an oversight capacity. Our management is responsible for the integrity of the Company’s financial statements, as well as its accounting and financial reporting process, principles and internal controls to assure compliance with accounting standards and applicable laws and regulations. Our independent registered public accountants have the primary responsibility for performing an independent audit of our financial statements and expressing an opinion as to the conformity of such financial statements with generally accepted auditing principals and on the effectiveness of the Company’s internal controls over financial reporting. Members of the Audit Committee are not professionally engaged in the practice of auditing or accounting, and all members are not experts in the fields of accounting or auditing, including auditor independence. The Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for preparing financial statements and reports and implementing internal controls over financial reporting. In addition, the Audit Committee selects the Company’s independent registered public accountants and has the authority to engage independent counsel and other advisors as it deems necessary.

In this context, the Audit Committee has reviewed and discussed the audited consolidated financial statements of Capstone contained in Capstone’s Annual Report on Form 10‑K as of and for the year ended March 31, 2016 with management and KPMG LLP, the Company’s independent registered public accounting firm for the year ended March 31, 2016. The Audit Committee has discussed with KPMG LLP the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T, both with and without management present. In addition, the Audit Committee has received and reviewed the written disclosures and the letter from KPMG LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding KPMG LLP’s communications with the Audit Committee concerning independence and has discussed with KPMG LLP their independence from the Company.

In the performance of their oversight function, the members of the Audit Committee necessarily relied upon the information, opinions, reports and statements presented to them by management of the Company and by the independent auditors. Based on the review and discussions described above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10‑K as of and for the year ended March 31, 2016 for filing with the SEC.

|

|

|

|

|

Audit Committee

Richard K. Atkinson, Chairman

Noam Lotan

Eliot G. Protsch

Gary D. Simon

|

The information contained in this report shall not be deemed to be “soliciting material” or “filed” with the SEC or subject to Regulation 14A other than as provided in SEC Regulation S‑K, Item 407 or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically requests that the information be treated as soliciting material or specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

FEES AND SERVICES OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Fees Paid to the Independent Registered Public Accounting Firm

The table below provides information concerning fees for services rendered by KPMG LLP during the 2016 Fiscal Year and the fiscal year ended March 31, 2015 (the “2015 Fiscal Year”). The nature of the services provided in each such category is described following the table. Representatives of KPMG LLP will be at the annual meeting, will have an opportunity to make a statement if they desire and will be available to respond to appropriate questions.

|

|

|

|

|

|

|

|

|

|

|

|

Amount of Fees

|

|

|

Description of Fees

|

|

2016

|

|

2015

|

|

|

Audit Fees

|

|

$

|

775,000

|

|

$

|

700,000

|

|

|

Audit-Related Fees

|

|

|

125,000

|

|

|

—

|

|

|

Tax Fees

|

|

|

15,000

|

|

|

15,000

|

|

|

All Other Fees

|

|

|

—

|

|

|

—

|

|

|

Total

|

|

$

|

915,000

|

|

$

|

715,000

|

|

Audit Fees—These fees were primarily for professional services rendered by KPMG LLP in connection with the audit of the Company’s consolidated annual financial statements and reviews of the interim condensed consolidated financial statements included in the Company’s quarterly reports on Form 10‑Q for the first three fiscal quarters of the 2016 Fiscal Year and the 2015 Fiscal Year, respectively. The fees also relate to the audit of internal controls over financial reporting (pursuant to Section 404 of the Sarbanes‑Oxley Act) for the 2016 Fiscal Year and the 2015 Fiscal Year, comfort letters and consents related to SEC filings.

Audit‑Related Fees—These fees were for services rendered by KPMG LLP in connection with the April 19, 2016 public offering of 2.7 million shares of the Company’s common stock.

Tax Fees—These fees were for services rendered by KPMG LLP for assistance with a research and development tax credit study.

Pre‑approval of Services Performed by the Independent Registered Public Accounting Firm